Sustainability at BBVA

BBVA made sustainability one of its strategic priorities

BBVA and its commitment to sustainability

In 2020, BBVA made sustainability one of its strategic priorities, and in 2021 it created the global sustainability area, led by Javier Rodríguez Soler, who is part of the organization's top executive line.

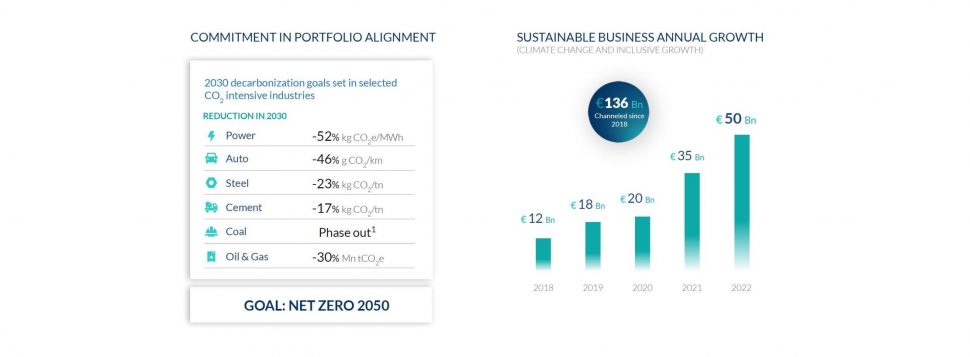

BBVA recently raised its goal of channeling sustainable financing to €300 billion by 2025 - tripling its initial target of €100 billion, set in 2018.

In climate action, BBVA is taking steps to meet its commitment to be carbon neutral by 2050, not only in its own emissions (where it already is) but also in those of clients. The bank will stop financing coal companies by 2030 in developed countries and by 2040 elsewhere. In addition, BBVA has set intermediate targets to decarbonize its portfolio in five CO2-intensive industries (power generation, automobiles, steel, cement, and oil and gas) by 2030.

In inclusive growth, BBVA has a Community Commitment set for the period 2021-2025, in which it will allocate €550 million euros to social initiatives. This is the most ambitious social plan launched to date by the bank.

BBVA, Europe's most sustainable bank for the third year in a row in the Dow Jones Sustainability Index

For the third consecutive year, BBVA obtained the highest score in the European banks category, and the second highest score globally in the latest Dow Jones Sustainability Index - the benchmark global reference for sustainability. The annual analysis was published on December 9th, and included a total of 25 banks this year.

The BBVA Group renewed its presence on the world’s most renowned sustainability indexes: the Dow Jones Sustainability Index World and Europe. Meanwhile, BBVA Peru and Garanti BBVA were once again included in the DJSI MILA Pacific Alliance and DJSI Emerging Markets, respectively. They are the only banks in Peru and Turkey to appear in these indexes.

BBVA had a total score of 86 points out of 100. The bank achieved 89 points in the economic and corporate governance dimension, 74 points in the environmental dimension, and 88 points in the social dimension. In addition, BBVA achieved the highest score (100 points) in several areas included in the assessment: financial inclusion; environmental and social information; fiscal strategy; crime prevention; public influence or lobbying; and human rights.

“This recognition as Europe’s most sustainable bank for the third consecutive year reaffirms the success of our strategy for a greener and more inclusive future. At BBVA, we finance, support and advise our customers and society as a whole, with a dual focus: the fight against climate change and inclusive growth,” stated Javier Rodríguez Soler, BBVA's Global Head of Sustainability.

This year, over 10,000 listed companies were invited to participate in the analysis conducted by S&P Global CSA. Assessed companies filled out an extensive questionnaire comprising almost one hundred questions on Environmental, Social and Governance (ESG) issues, which includes public and non-public data on the participants. Only the top 10 percent of companies in each sector in this analysis were selected to join the Dow Jones Sustainability Index (DJSI).

Assessment by the rating agency S&P determines companies' inclusion in this Dow Jones Sustainability Index. The composition of the index was announced on December 9th.